Students Juggle Jobs, Adopt Ways to Tackle Loan Debt

By Abby Zimmardi

The Razorback Reporter

Students are struggling to finance their college education by working two jobs or even changing their residency to manage the cost and stress of escalating student loan debt.

Gabrielle Abbott, a UA junior majoring in electrical engineering, said she is paying for her education by herself with the help of loans and scholarships.

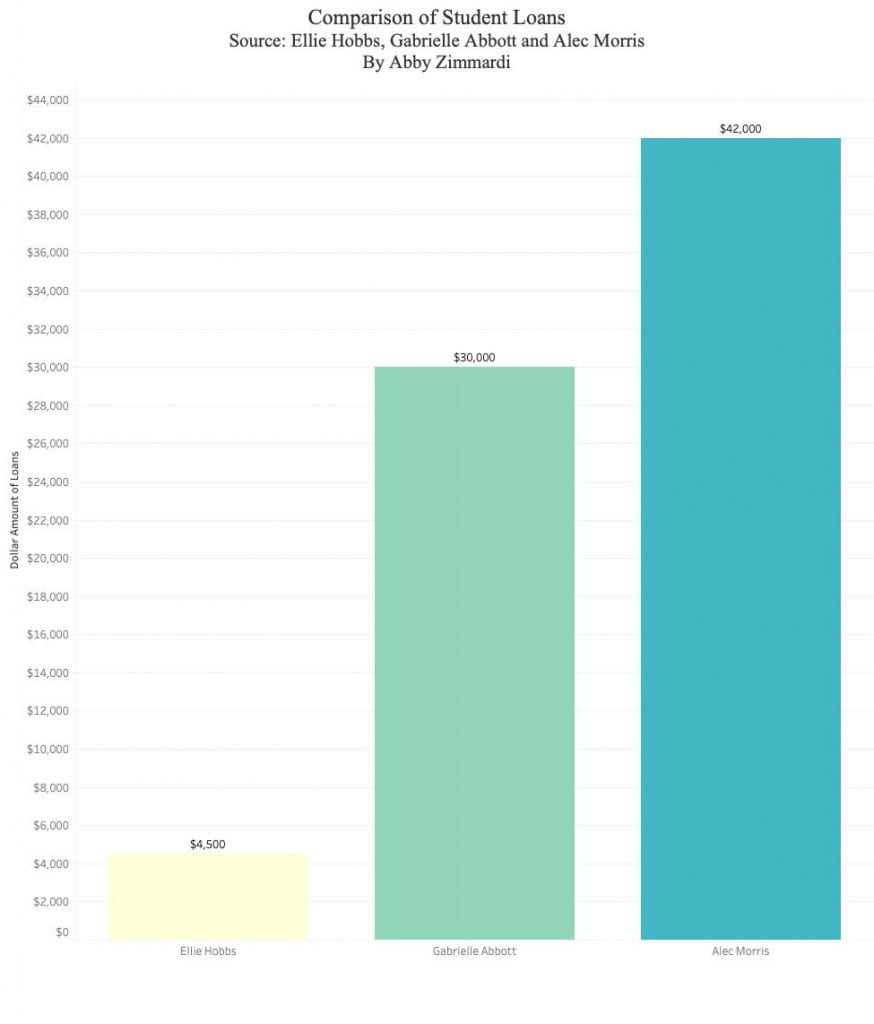

Abbott has collected around $25,000 to $30,000 in student loans because she has taken out loans for five semesters and two summers. In the end, these loans will equal the cost of a brand new car.

“It’s a very big burden to have as a student and I think it’s crazy that inflation is so much,” Abbott, 20, said. “I work two jobs to pay my bills so I take the money that I make over the summer and I work during the school year too, to pay all my bills.”

Abbott works on campus for the College of Engineering as a peer mentor and she also works an average of 20 hours at Chick-fil-A on the weekends, she said.

In the summer of 2019, Abbott worked a paid internship as a power transmission engineer for Arkansas Electric Cooperatives in Little Rock, she said. She saved the money she earned to pay for living costs during the 2019-20 school year.

“All of the money I have from that is what I’m using to try to ride out all of my rent through May,” Abbott said. “So, from August to May. So, my rent, my water, my electric and Wi-Fi.”

Although on average, females have more student loan debt than males, Alec Morris, a UA senior majoring in chemical engineering, has more loan debt than Abbott.

Morris has around $42,000 in student loans from his first seven semesters at the University of Arkansas, he said. In order to lower the amount borrowed, Morris changed his residency to Arkansas from Tennessee in order to have in-state tuition, he said.

Because Morris has in-state tuition, it will take him 10 years to pay off his student loans if he does the maximum payment of $500 a month.

“I’m just gonna max it out whatever it is,” Morris said. “So, it’ll probably take me like seven to 10 years.”

Morris also has more debt than Ellie Hobbs, a UA sophomore majoring in civil engineering. She has around $4,500 in student loans from her first three semesters at the university, Hobbs said. She is planning on taking out more loans for her remaining years at the UofA.

Hobbs, 19, is also considering taking out loans for a potential study abroad opportunity, she said.

Although Hobbs will be taking out more loans for her education, she is not focusing on paying back her loans while in school, she said.

In contrast to Hobbs, Abbott is thinking about how she will pay back her loans and she has the aid of scholarships to help her clearly map out a plan, she said.

Abbott has received $18,000 in scholarships in total since her freshman year, she said. She has received the Academic Challenge Scholarship for $4,000, she also received a $2,000 scholarship from the university and a $2,500 scholarship from Chick-fil-A for her junior year.

It will take Abbott five to six years to pay her loans off after she graduates, but she wants to pay as much as she can and try to pay them off in one or two years, Abbott said.

“My current plan is to just take my salary and subtract how much loans I have and then obviously a livable salary as far as rent and bills and everything and try and pay it back in one to two years,” Abbott said. “Just because it’s such a big burden, it’s very overwhelming.”