First-Gen Students Work, Borrow to Pay For College

By Mary Fracchia, Mary Hennigan and Elena Ramirez

The Razorback Reporter

Aaron Alamo, a junior at the University of Arkansas, is the first in his family to attend college.

His mother, a first-generation immigrant from Mexico, didn’t receive a good education.

“She really wanted us to have a good one, so she moved to the United States,” Alamo said. “She didn’t really have that opportunity.”

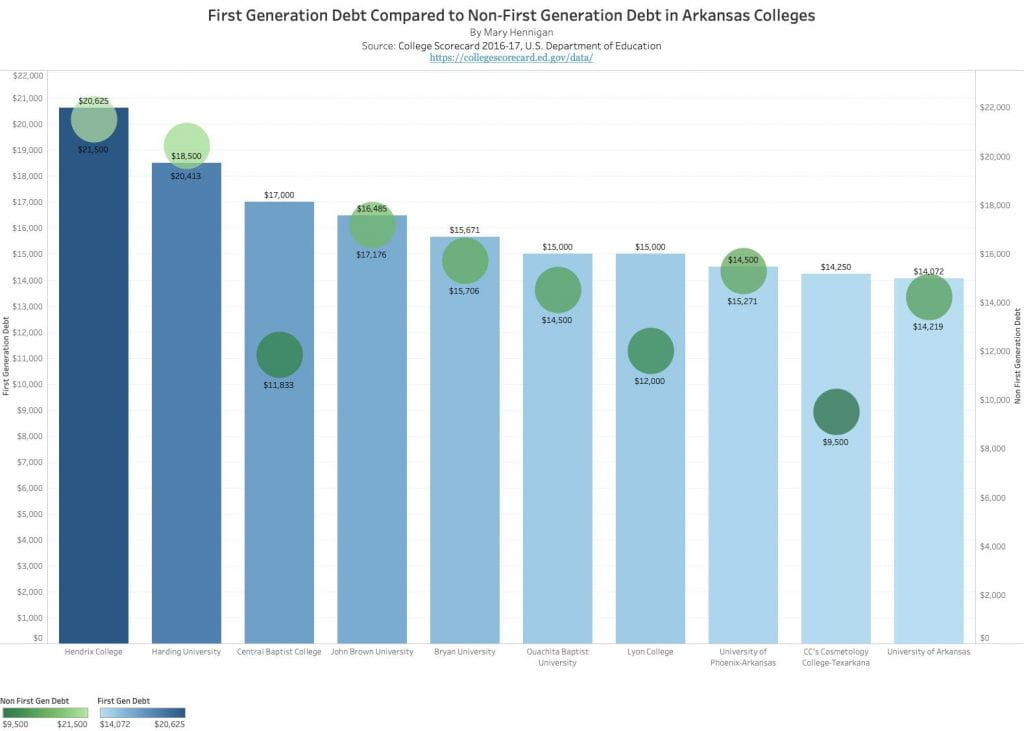

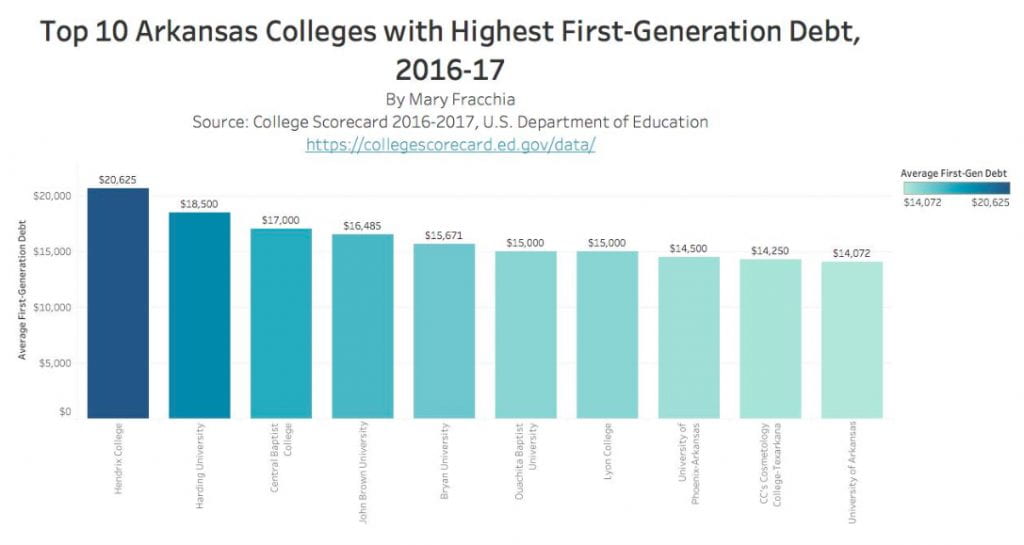

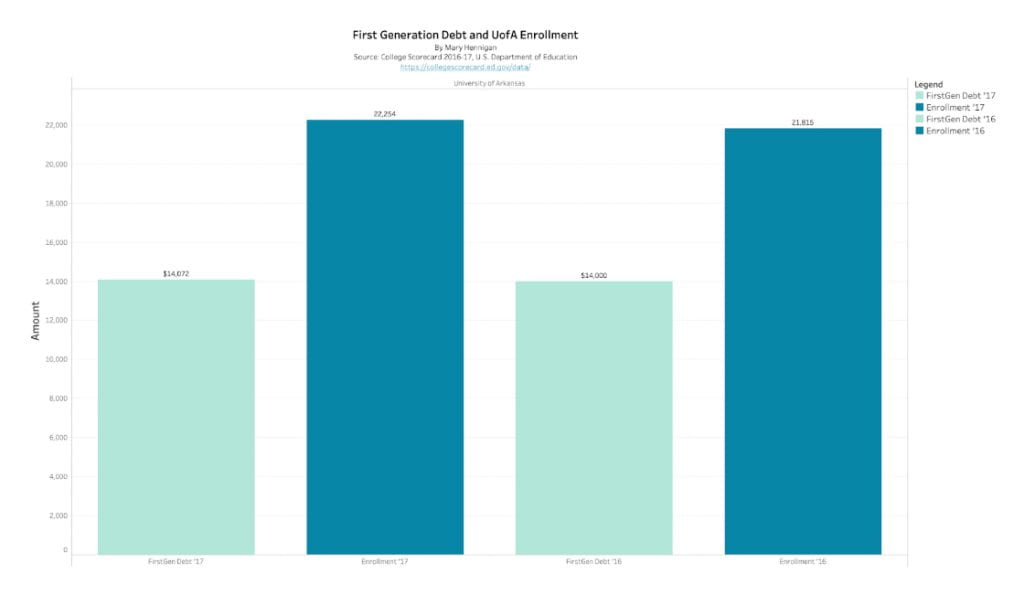

Alamo, like many first-generation students, is accumulating student loan debt, now about $20,000. Alamo’s debt burden is above the median debt load of $14,072 for first-generation students at the UofA in the 2016-17 year, according to College Scorecard, a U.S. Department of Education database. That’s close to the median debt load for all UofA students that year.

While this is a significant burden, Alamo said it motivates him to stay in school. Although he wanted to come to college for a better future, he is worried about the prospect of making payments.

About one-quarter of all University of Arkansas students are the first in their families to attend college, according to UA Office of Institutional Research data. The university’s $14,072 in median first-generation student loan debt is higher than the statewide debt for first-generation students, $9,421 in 2016-17, according to College Scorecard.

Interviews with a variety of first-generation students show they are paying for college through a combination of part-time jobs, scholarships, and in some cases, with family support. Alamo, for example, pays for the remaining college costs with earnings from his part-time job as a dispatcher at J.B. Hunt Transport Services, Inc.

As a first-generation student, Kathryn Archila, a UofA senior, said she had difficulty understanding which scholarships to pursue and how to navigate the loan process. She collected $6,000 of federal student loan debt at University of Central Arkansas in Conway, she said. She will have more debt attending the UofA because she is taking more classes.

Archila said she has two part-time jobs, one at Target and the other as a teacher’s assistant. She plans to become a music teacher in Rogers after graduation. She decided to stay in Rogers, her hometown, where she makes a weekly commute to Fayetteville.

Brandon Davis, who graduated in May, plans to begin paying off his $40,000 student loan debt in November, he said.

“I look at student loans as an investment in your future,” Davis said.

Davis graduated with a Bachelor of Arts in Journalism in four years, and currently works part-time for KNWA-TV, he said.

“I would not trade my four years at the UofA for anything,” Davis said. “[The debt] is there, but you can’t take away those four years of memories and all the people I met along the way.”

Not all first generation students have student loan debt. Kevin Azanza said he is excited to be the first in his family to afford to go to school “My school is paid for by scholarships, my parents and by me. I have [looked into private loans] but that is definitely one of the last things I want to go to when it comes to paying for school,” Azanza said. He has no loan debt.

He works part-time as a customer service associate at Walmart Inc. He has classes three times a week and commutes from Rogers. Azanza transferred to the UofA after paying two years of out-of-state tuition at Northwest Arkansas Community College, or NWACC. Azanza is majoring in both communications and political science.

Another first-generation student is Victoria Toan, a UofA senior, who paid for this semester a few weeks ago, she said.

Toan started saving for college after getting her first job at 16 years old. “If college is something you want to do, you start saving as early as you can,” Toan said. In addition to working for her college, Toan received a FAFSA scholarship and a Cherokee Nation scholarship, she said. Toan’s parents would not pay for her college, she said.

“I’m grateful for that,” Toan said. “It gave me a sense of responsibility. Graduating without student debt feels great.”