UA Students Uncertain of How to Pay Student Loans

Some but not all University of Arkansas students have mapped out plans for their future careers and strategies to repay student loans.

By Mary Hennigan

The Razorback Reporter

Lane Murphy, UA senior, has collected around $30,000 in student loan debts for his biology undergraduate degree, and he is just getting started. Murphy plans to attend graduate school, and his student loan total is expected to grow to around $250,000.

With the aspiration to be a surgeon, Murphy is hoping to have his future workplace offer loan forgiveness.

“I have no idea how I would pay without a hospital residency,” Murphy said. “I’m putting a big risk on hoping that the hospital will pay.”

Murphy, 21, is among many U of A students who face considerable uncertainty about how they intend to pay off student loans.

The UA post-graduation employment rate was 64% for the Class of 2017 and student loan debt averaged $21,500, according to UA career data and federal College Scorecard, U.S. Department of Education database.

The Career Development Center offers resources such as counseling and résumé reviews for all UA students, but many reported waiting until their later college years to seek help.

“Students should start preparing day one of their freshman year,” said Carolyn Chitwood, director of career education. “But that’s not necessarily what everyone is going to do. If you wait until you’re looking for a job, you haven’t built up those connections.”

While it is common to wait until the later years to think about careers, some students reported thinking about their future for a few years before coming to college.“It is more beneficial if you have an idea going into it, but not necessary,” Chitwood said. “Career trajectory is a life-long process. If you know where you’re headed, it’s easier to make decisions, but those decisions may change.”

Murphy started planning his future when he was a junior in high school after he shadowed a general surgeon, he said. His parents encouraged him to have a plan before leaving for college.

Murphy can earn an annual wage of $255,110 as a surgeon, according to Bureau of Labor Statistics data. He thinks becoming a medical professional will be the only way to repay his loans, he said.

Another UA student, Elizabeth Smith, a freshman majoring in history, started planning for her future at the beginning of high school, she said. She is expected to collect around $20,000 in student loan debt by graduation.

“I’ve always been a pretty Type-A kind of person,” the 19-year-old said. “I like to know what’s going to happen even if it’s a tentative plan. I’d like to have [the loans] paid off before I’m 30.”

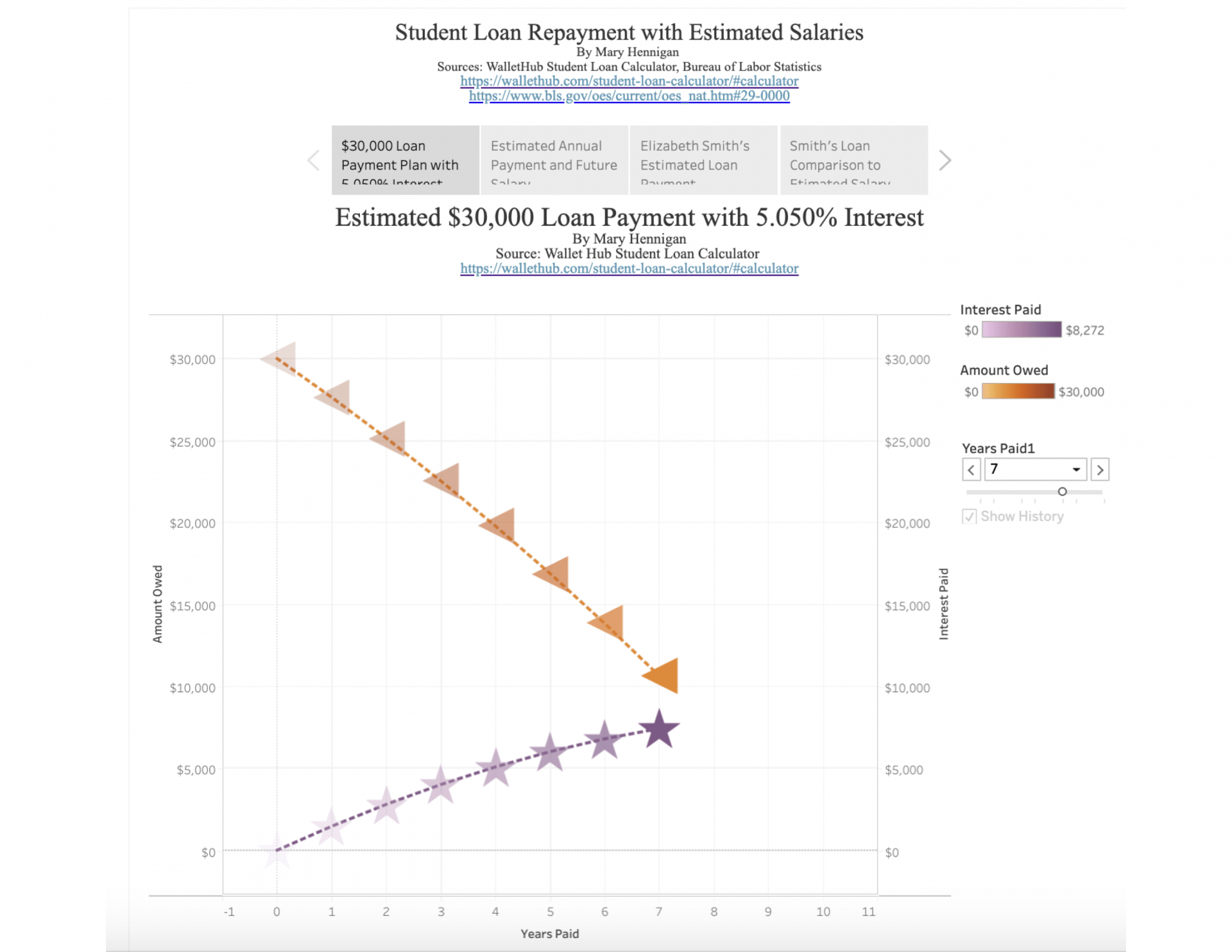

If Smith graduated as a 22-year-old and earned the average high school teacher’s wage of $64,340, it would take $3,048 of her annual earnings to be debt-free by age 30, according to Bureau of Labor Statistics data and the WalletHub student loan calculator.

Jessica Park, career services specialist and co-op coordinator for the College of Engineering, encourages students to think beyond their future salaries. Photo by Mary Hennigan

As students approach graduation, the pressure to make decisions can grow. Deciding where to live, what quality of life they want to have and looking beyond the salary are all things Jessica Park, career services specialist and co-op coordinator for the College of Engineering, recommends to students.

“Where you live, what you’re doing eight hours per day, the benefits package offered and your quality of life makes a big difference beyond just the salary,” Park said.