Females Face High Student Debt at Technical Schools

By Kirsten Baird

The Razorback Reporter

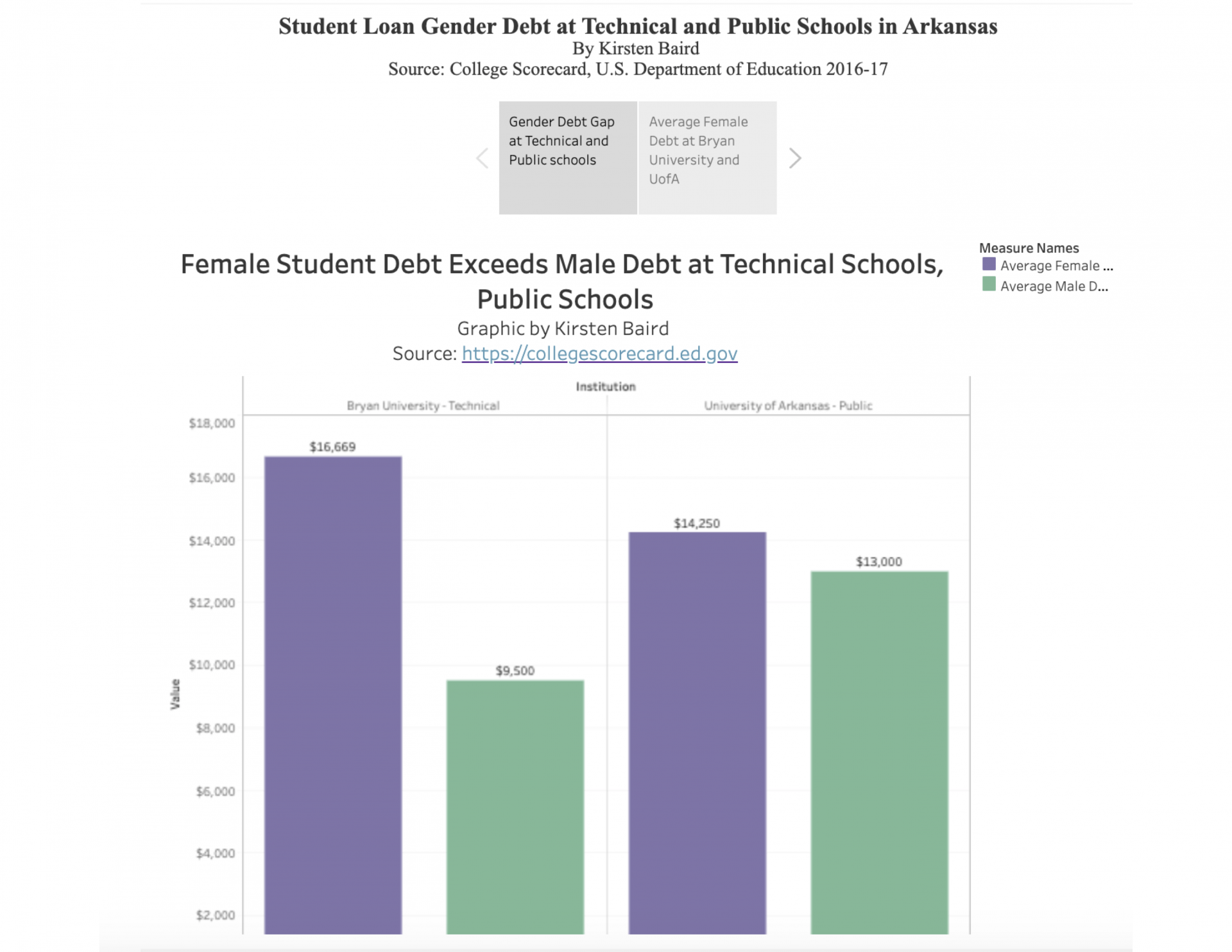

Female students who graduate from Bryan University, a technical school in Rogers, have an average of about $18,000 in student loans. This is $9,375 more than male graduates accrue, according to U.S. Department of Education student loan data from 2016-17.

Bryan has the largest gender gap in student loans in Arkansas, according to the College Scorecard, an Education Department database. An official at Bryan declined to comment.

Furthermore, the data shows that this gap is almost $3,000 more than Lyon College, a private school with the second largest gender debt gap.

In contrast to technical schools, larger public universities such as the University of Arkansas have a gender debt gap of about $900, according to the College Scorecard student loan data.

The nature of technical schools differs from that of public universities in the sense that there are often fewer core classes and more hands-on experience related specifically to career training, according to the U.S. Department of Education.

When comparing the percentage of males to females for Bryan and UofA, there is a difference in the cost and disbursement of money.

According to the 2016-17 U.S. News & World Report for Education, Bryan University is about 30% female and 70% male. The average scholarship awarded at Bryan is $5,145, according to the U.S. News, which is significantly less than the average amount of tuition per year.

The UA Enrollment report shows that the University of Arkansas is 52% female and 48% male.

Interviews with female students at the U of A show the range of experiences in financing college. Mallorie Spielmaker, 19, from Fayetteville, Arkansas is a second-year special education major at the University of Arkansas. She said she has the Arkansas Academic Challenge scholarship and a leadership scholarship offered through the university.

“This year it was $4,000 for the whole year,” Spielmaker said. “The leadership is $1,000 per semester.”

After one and a half years in school, Spielmaker has had to borrow $15,000 in student loans. “By the time I graduate, it will probably be closer to $25,000,” Spielmaker said.

Another UA student, senior Chloe Shreve, 22, is a political science major who has had to borrow money to pay for school even though she received federal grants. Shreve had a scholarship in her freshman year called the Freshman Success scholarship, granted to students whose parents didn’t attend college.

Even with the scholarship money, Shreve said she still had to borrow in order to pay for school.

“I am pretty sure I am going to be graduating with around $10,000, because I get a lot from FAFSA,” Shreve said. The total Shreve receives in Federal Pell Grants from the university is about $3,500 per year, she said.

Additionally, the length of time in school could have an impact on the amount of student loan debt that a student accrues.

At Bryan, the program that most female students choose is the Business Administration and Management with an emphasis in spa management, which is one of the longest programs at the school, according to the Bryan University academic report. The length of time attending school can tend to lead to higher student borrowing. Generally speaking, females are enrolled in school for a longer period of time, according to the U.S. Department of Education.