Female Student Loan Debt Exceeds Male Debt in Arkansas

Throughout Arkansas, females graduate from college with more student debt than men. Lack of scholarships and the gender pay gap contribute to this problem.

By Kirsten Baird, Coleman Bonner and Abby Zimmardi

The Razorback Reporter

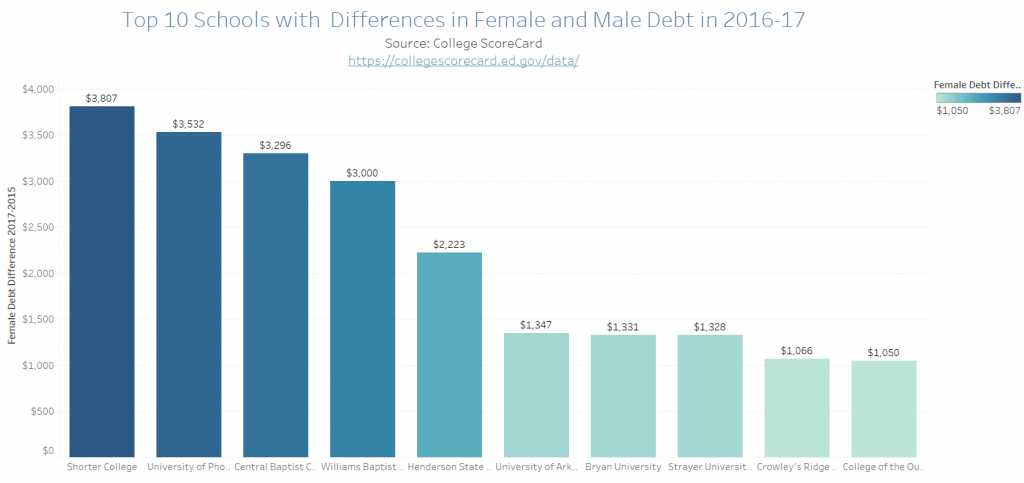

Female students graduate from college with an average $1,165 more student loan debt than male students within colleges and universities in Arkansas, according to an analysis of 2016-17 federal student loan data.

College Scorecard, U.S. Department of Education database, showed the median debt for female college graduates was an average $10,029 in 2016-17 versus $8,864 for male graduates in Arkansas.

The gap between female and male student loan debt held true for the 2015-16 academic year, when female graduates faced an average $1,333 in more debt than male students, according to College Scorecard.

The reality of today’s competitive workforce is that a degree is required for almost every career, and many studies show that the pay gap between males and females still exists. According to the Institute for Women’s Policy Research, women only made 49% of what men earned over a 15 year time span. Thus, upon graduation, it is hard for females to pay off their loans quickly.

“I just know of a lot of guys who have their entire school paid for by going here and I don’t know of many girls really,” said Madison Spyres, a fifth-year music education and exercise science major at the UofA. “It’s a little strange that females don’t have more scholarships.”

Spyres, 22, has been taking out loans since her sophomore year, she said. The first semester she took out $2,000 and every year after that she has taken out $7,500.

Priscilla DuFresne, a University of Arkansas junior who is majoring in graphic design, has felt the impact of student loans. DuFresne, who is paying for college on her own, said she needs to take out the maximum amount of loans possible each year in order to pay for school.

“Last year I had around $13,000 but I know I had to take out loans this year so it’s probably around $20,000,” DuFresne, 20, said. In addition to borrowing loans for tuition, DuFresne said she uses loans in order to pay for art supplies for classes.

Luke Molina, a Dallas resident and senior business student at the UofA, faces large college expenses since he pays out-of-state tuition. However, Molina says he is confident in his ability to pay off the loans following his graduation because of the resources and networking he’s acquired in his time in school.

“It was a little hard to decide to take out loans,” Molina, 21, said. “But I had to do what I had to do, it was either that or go home.”

Kristie Spielmaker, a UA alumni and current Director of Supply Chain Flow Performance at Walmart, had an academic trajectory that was different from the usual trend. She started attending the university after she was already married and had children.

Spielmaker said she received about $4,000 per year from the UofA, a total of $10,000 over the course of two years through the Brandon Burlsworth scholarship, and about an additional $2,000 per year through Walton College. This totaled about $34,000 from 2008-2012.

“I had a lot of student loans, as we used them for living expenses since we had a family and I was not earning an income while in school,” Spielmaker said. Even now, with a good job and good scholarships, Spielmaker still has about $20,000 worth of student loans to pay off.