Students Seek Student Loan Financial Advice

By Emily Thompson & Brooke Borgognoni

The Razorback Reporter

As Kat de Sonnaville, a 21-year-old senior, wraps up her studies at the University of Arkansas, she wishes the college offered one more course: financial literacy to help her navigate the student loan application and repayment process.

“I think the university should make a financial literacy course a requirement for all students who take out loans,” said de Sonnaville, who faces $18,500 in student loan debt. “I want to know what paying back my loans are going to look like, how long I’ll have to pay them back and helpful tips on staying on top of debt after college.”

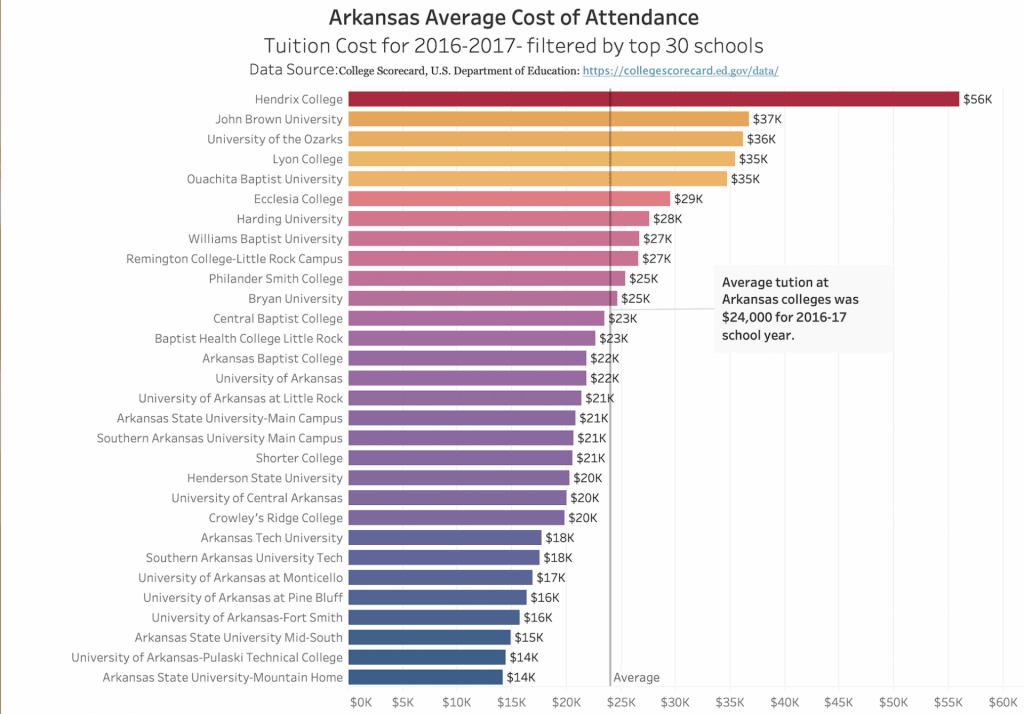

Students graduating from the University of Arkansas, the state’s largest school, had median student loan debt of $21,500 in 2016-17, unchanged from the year earlier, according to College Scorecard, a U.S. Department of Education database. The UofA had 22,254 students enrolled in 2016-2017 and tuition was $22,000. According to College Scorecard, 47 percent of them received Pell grants.

The average student loan debt in Arkansas was $14,926 in the 2016-17 academic year, up $136 from the year earlier, according to College Scorecard. The median debt loads ranged from $3,500 at East Arkansas Community College to $34,240 at Strayer University for the 2016-17 academic year.

De Sonnaville, a first generation student, gained information about student journalism scholarships by speaking with her professors during office hours. She now credits the School of Journalism and Strategic Media for providing that guidance and making it financially possible to finish out her degree at the UofA.

“I have received many scholarships from my department, the School of Journalism and Strategic Media,” de Sonnaville said.

Between jobs and scholarships, de Sonnaville does not have to take out loans this year. De Sonnaville supports herself through two on-campus jobs. She works as a Resident Advisor for Maple Hill South and as a multimedia intern at the College of Engineering. These two jobs provide de Sonnaville with free room and board, a monthly stipend and biweekly paychecks.

De Sonnaville said that she is concerned that the UofA will not reach out to her about paying off the loans after she graduates in May. Each loan provider has their own rules and regulations on when and how student loans must be repaid.

The University of Arkansas offers a variety of scholarships and programs aimed at keeping costs down for students. Some of these scholarships total up to $16,000, offering a $4,000 award renewable for up to four years. They also offer programming to help students navigate the challenges that come with college life.

Student Support Services is a federally funded program through the Department of Education that helps first-generation students, low income students and students with disabilities obtain a college education. Student Support Services is a national program and the services it provides varies based on the college. At the UofA, some of the services it provides include workshops on topics like applying for financial and time management, one-on-one guidance with student support specialists and grants.

Ramon Balderas, a UofA student development specialist and student retention coordinator, said that college, particularly learning how to finance it, can be more difficult for first-generation students.

“You could be the most intelligent student, get straight A’s all through high school, but if you are put into a system that you don’t know how to navigate, it’s going to complicate your journey,” said Balderas, a first-generation college student.

De Sonnaville, however, said initiatives like Student Support Services did not provide the loan counseling and financial literacy services she needed.

Shorter College students saw the biggest increase in student debt in 2016-17. The median student debt load for Shorter College students increased $4,000 between 2015-16 and 2016-17 academic years to $28,000 for 2016-17 at Shorter College.

Shorter College is a private, faith-based, two-year liberal arts college in North Little Rock. It is also one of 110 Historically Black Colleges and Universities in the U.S. Graduates of Shorter College earn an associates degree in general studies, according to their website.

There were 446 students attending Shorter College in 2017. The average cost for the 2016-2017 academic year was $20,500. According to College Scorecard, 87 percent of Shorter College’s students receive a federal Pell grant for low-income families.